Weekly Outlook

Bitcoin to 65K USD, U.S. durable goods orders and consumer confidence dropped, RBNZ keeps rates steady, U.S. PCE inflation steady, E.U. inflation lower, BOC and ECB decide on rates, NFP on the way

PREVIOUS WEEK’S EVENTS (Week 26.02-01.03.2024)

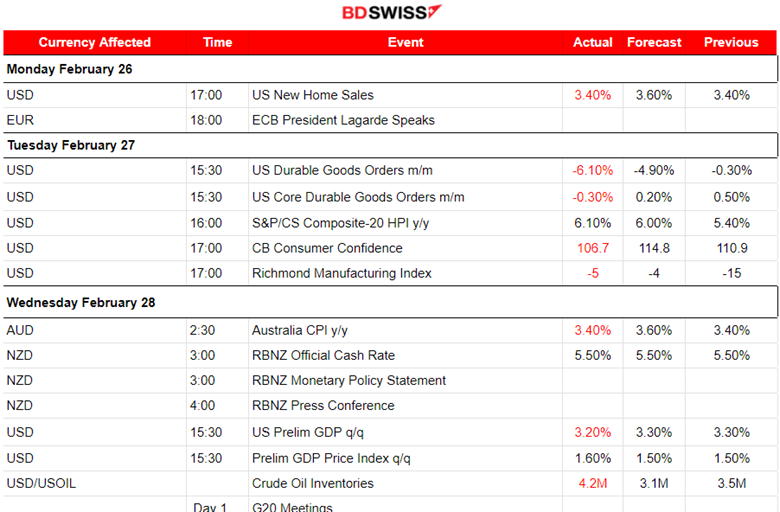

Announcements:

Crypto

Bitcoin jumped surprisingly since the 26th Feb, reaching currently near 65,000 USD. The Crypto market in general saw huge gains as all Crypto with the highest market cap moved to the upside.

Recent analysis shows that there is a surge of funds into bitcoin ETFs. Another factor that explains the bullish phenomenon is the upcoming “halving event”

U.S. Economy

Reports on the U.S. durable goods figures show that orders fell by the most in nearly four years in January, while business investment in equipment appeared to have eased, signs that the economy lost momentum at the start of the year.

The report on consumer confidence shows that Americans are quite concerned about the economy’s outlook, especially the labour market, and the upcoming presidential election resulting in confidence retreating after three straight monthly increases. The Conference Board (CB) showed its consumer confidence index slipped to 106.7 this month from a downwardly revised 110.9 in January.

______________________________________________________________________

Interest Rates

RBNZ

The RBNZ decided to keep the cash rate steady at 5.5% and trimmed the forecast peak for rates, catching markets by surprise. The RBNZ’s statements triggered a selloff in the New Zealand dollar and a rally in bonds.

The bank lowered its forecast cash rate peak to 5.6% from a previous projection of 5.7% – toning down its hawkish stance and effectively reducing the risk of further tightening.

The RBNZ’s statement reflected the need to keep policy restrictive for a while in order to bring inflation below the top-end of its 1% to 3% target band.

______________________________________________________________________

Inflation

U.S.:

The personal consumption expenditures price index (PCE) excluding food and energy costs increased by 0.4% for the month and 2.8% from a year ago, as expected.

PCE, including the volatile food and energy categories, increased by 0.3% monthly and 2.4% on a 12-month basis, also in line.

Personal income rose 1%, well above the forecast of 0.3%. Spending decreased by 0.1% versus the estimate for a 0.2% gain.

Initial jobless claims totalled 215K for the week ended Feb. 24, up 13,000 from the previous period and more than the 210,000 estimate.

Eurozone:

Eurozone’s inflation saw a drop last month but underlying price growth remained stubbornly high. This might hold elevated rates for longer.

Inflation across the 20-nation Eurozone fell to 2.6% in February from 2.8% a month earlier, just shy of expectations for 2.5%, data from Eurostat. However, crucial core figures only declined to 3.1% from 3.3%, missing expectations for 2.9% and holding uncomfortably above the ECB’s 2% target.

The ECB has kept its deposit rate at a record high of 4% since September.

Markets now see around 90 basis points of rate cuts this year with the first move coming in June, a date that has been mentioned by a host of policymakers, too, as a reasonable start for rate cuts.

______________________________________________________________________

Sources:

https://www.cnbc.com/2024/02/27/bitcoin-surpasses-56000-benchmark-in-latest-rally.html

https://www.cnbc.com/2024/02/29/pce-inflation-january-2023-.html

https://www.reuters.com/markets/europe/dip-euro-zone-inflation-bolsters-case-ecb-easing-2024-02-29/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 26.02-01.03.2024)

Server Time / Timezone EEST (UTC+02:00)

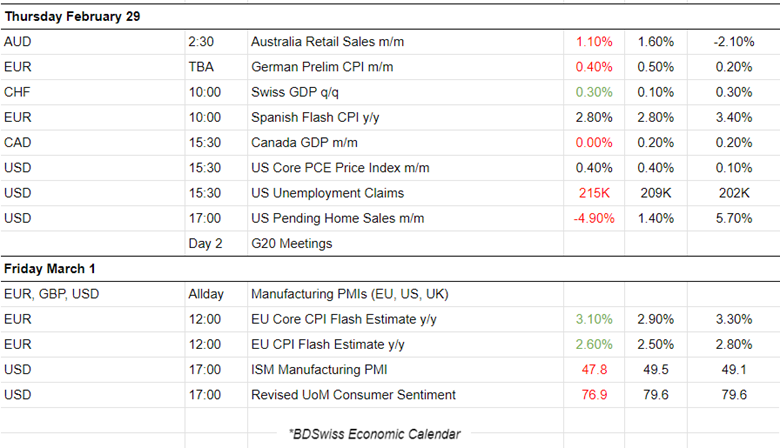

Manufacturing PMIs:

Eurozone PMIs:

The Spanish PMI was reported to be 51.5, a turn to expansion, with rising new orders and output. Employment growth is also notable. Confidence in the future improved to its highest level for two years.

The Italian manufacturing sector remained in the contraction territory during February with a PMI reported at 48.7 points. Weak demand and lower order numbers caused the reduction of production volumes. Companies increased workforce levels during that time though.

The French production downturn continued falling at its weakest since January 2023. The reported PMI was just 47.1 points, at least an improved one, as contractions in output and new orders cooled significantly. Slower declines in purchasing activity and employment were also recorded.

The German manufacturing sector is worsening. The reported PMI is very low, at 42.5 points indicating that the Eurozone’s largest economy is having a good hit as rates of decline in manufacturing output and new orders have quickened.

The Eurozone manufacturing sector shows signs of recovery even though contraction of the sector continues. New orders and purchasing activity signalled lower rates of decline in close to a year in February. Production levels decreased midway through the first quarter, the rate of contraction held steady though.

UK PMI:

The U.K. manufacturing sector downturn continues. Weak demand and the Red Sea crisis were playing a significant role in the contraction. Disruption in production and vendor delivery schedules due to the Red Sea crisis created difficulties in delivering, driving up costs. Demand also remained weak, with new order intakes falling at the fastest rate since last October.

U.S. PMI:

In the U.S. the manufacturing conditions improve at the fastest pace since July 2022 according to S&P Global’s report. The sector experienced a quicker pace of improvement. A renewed increase in production and a quicker rise in new orders. The reported PMI figure is relatively high in expansion territory, with 52.2 points.

_____________________________________________________________________________________________

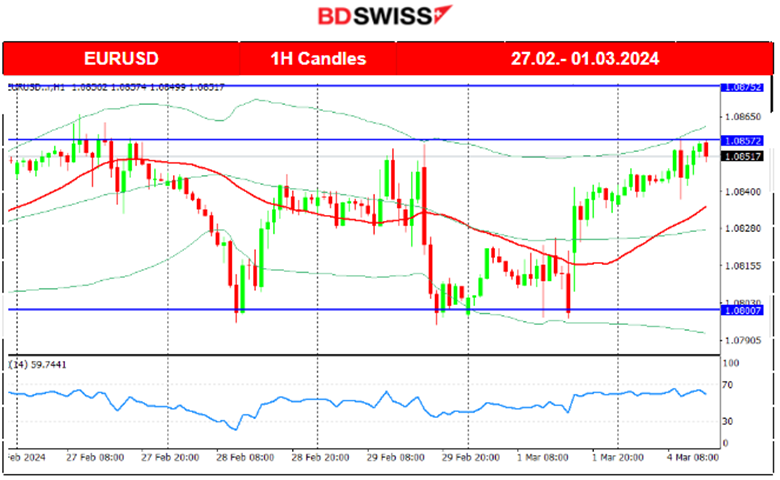

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The dollar index moved sideways with high volatility last week, not showing any significant weakening as expectations regarding interest rate cuts remain stable with high borrowing costs to be longer than expected. This might change next week with the labour data releases and Fed’s Powell statements. Consumer confidence dropped and orders for durable goods as well. However, the USD remained strong, always retracing to the 30-period MA during this period.

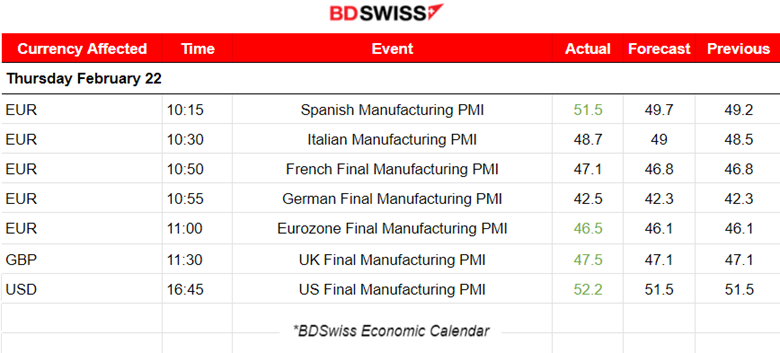

EURUSD

EURUSD

The EURUSD path is greatly affected by the USD since the USD is usually the main driver. The European Central Bank expressed their intentions many times in regards to interest rate policy highlighting the fact that they are keeping interest rates high as long as needed until inflation is lowering with the desired pace, towards target. The EUR is currently not affected much by the news. The recent CPI Flash estimates figures on Friday showed that inflation in the Eurozone eased to 2.6% in February, but both the headline and core figures were higher than expected. Only a small impact was recorded in the market. However, in regards to U.S. related releases, we see that the market is quite sensitive to them, thus the big deviations from the mean. The pair is moving more to the upside currently as the USD weakens.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin continues to the upside as it breaks more and more resistance. The largest crypto passes 65,000 USD for the first time since Nov. 2021. It is driven by expectations of exchange-traded funds’ robust demand and the upcoming halving event. It noted an Incredible demand from the U.S.-listed Bitcoin ETFs, which began trading on Jan. 11. Bitcoin has jumped about 186% in the last 12 months.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

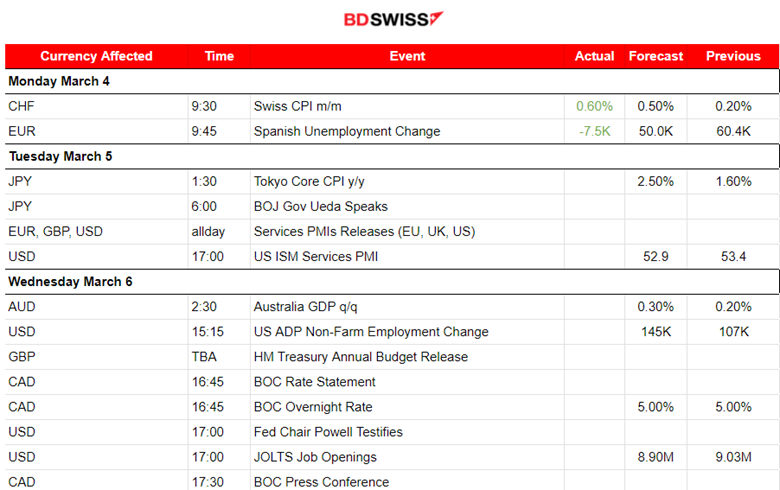

NEXT WEEK’S EVENTS (04 – 08.03.2024)

Coming up:

Two Central Bank Interest Rate Policy Decisions, Bank of Canada and European Central Bank.

Services Sector PMI releases completing the whole Business Conditions picture.

Canada and U.S. Labor Data Major Releases. NFP Expected lower.

Within the week statements from the Fed’s Powell will probably shake the markets.

Currency Markets Impact:

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

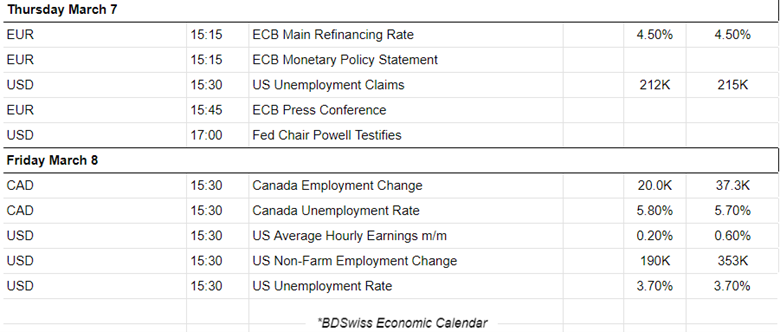

U.S. Crude Oil

On the 28th Feb, the price was clearly on a short-term uptrend, however, after finding important resistance near 79.20 USD/b it reversed to the mean level at 78 USD/b. A sideways but volatile movement followed and that changed on the 1st March. The price jumped high reaching the resistance at 80.3 USD/b before retracing back to 79.3 USD/b. There is no clear signal in regards to where the price is headed. If the uptrend continues as the support remains strong, obviously the price could reach the high, 80.3 USD/b level, once more.

Gold (XAUUSD)

Gold (XAUUSD)

Since the 29th Feb, Gold shows this upside momentum with the price moving quickly and unusually upwards since the demand for metals saw an increase lately. The dollar is also showing weakness. Gold should come down if it passes the 2080 USD/oz support level. That would trigger the retracement. The 2088 USD/oz resistance is actually very important. Looking at the daily chart Bollinger Bands for volatility measure it actually tells us that Gold experienced quite unusual high volatility and movement to the upside. The question is, will the resistance 2088 USD/oz hold this week, causing the price to drop?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

On the 29th Feb, all benchmark indices surged after the PCE report release showing a lower annual figure that caused the dollar to lose strength at that time. The momentum to the upside was strong enough to cause the index to move quite rapidly and further from the MA on its way up. Retracement followed today reaching the Fibo 61.8. A clear short-term uptrend for now. The RSI remains in the overbought area and if resistance holds, indices could see a drop soon. The alternative scenario is a sustainable jump after the NYSE opening that seems not so probable.

______________________________________________________________